In June, I wrote a post about the staggering growth of Android lately, especially in emerging markets. And yet, despite this growth, Android doesn’t monetize nearly as well as Apple’s iOS platform:

The monetization gap is understandable given the huge difference in price points between the iPhone and the hundreds of Android devices. Unlocked, the iPhone is the most expensive smartphone on the market. There’s one device and the only option is storage (and color). In contrast, the cheapest Android can be had for <$50. The vast majority of new smartphone users coming online in emerging markets are from the lower and middle income groups, many of whom are accessing the web for the first time ever. They can’t afford a $1000 device, which is what an iPhone can sell for unlocked.

This helps explain the monetization gap among other reasons (Android fragmentation, etc.) And it poses a problem for developers trying to make money from the millions of Android users in emerging markets. Mobile advertising really isn’t an effective strategy since ad markets are nascent – extremely small in aggregate size and much less productive (i.e., lower CPMs). And even on iPhone or in developed markets, ads can worsen the user experience and are tough to make money off of unless you have huge numbers of users or a highly valuable audience. So ad-supported isn’t a viable model.

What about paid app models? There are problems here as well. For the lower end of the market, willingness to spend just isn’t there. It’s hard enough to get someone to spend a few dollars upfront on a paid app download in developed markets, let alone in a market where a user might only be earning $5-10k a year, maybe less. So charging upfront doesn’t work well.

So what’s the solution? I think WhatsApp has figured out an interesting model. A user can use the service for free for a year, but after 12 months has to pay a flat $1 per year to continue using the app. It’s a sort of “micro SaaS” model. You get a 12-month free trial period and then have to pay an annual upfront fee to subscribe to the service.

WhatsApp has a very strong network effect, so the likelihood that someone who’s used the service for a year and whose friends are all using the service will balk after a year at paying $1 to continue subscribing is low.

At a $1 per year, WhatsApp is reasonably priced for any user that’s able to afford even a cheap Android device. A basic SMS plan will easily cost as much as WhatsApp charges for a year and will also be volume capped. It’s a good value.

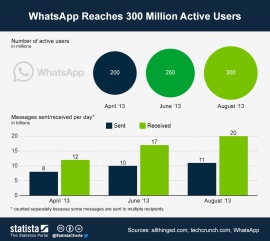

The downside of this model is that it really only works at large scale. Having 10m users paying you $1 a year isn’t a venture-scale business (though very interesting if you can bootstrap). At 300m, which is Whatsapp’s latest user count, this is a sweet business (see image below via Statista). And, as I wrote last week, Messaging happens to be “one of the two killer apps on the smartphone,” so it has huge addressable reach.

There’s also some risk that the service is challenged by free services that don’t ever charge for users to subscribe and look to advertising, freemium, or in-app purchases for monetization. At a $1 subscription, there’s really no sunk cost and there’s no technical challenges around switching as there might be in an enterprise SaaS. There is a huge switching barrier though in the network effect, so I think fears of WhatsApp displacement are overblown (not to mention the fact that it’s a simple, reliable, very well-designed product).

I’m not saying this model is for everyone. Mobile ads, mobile commerce, and in-app purchases work extremely well in some cases, especially in developed markets. But I’d like to see more services experiment with the “Micro SaaS” approach and would love to hear thoughts on other categories that are suitable.