The CBO released a revised US national debt forecast last month, which I wrote about here. Basically, a combination of the sequester, fiscal cliff, improving economy, etc. mean that the deficit as a percent of GDP will shrink over the next 2 years and then begin to slowly rise, all at a manageable rate. In other words, we’ve accomplished Republicans’ #1 economic priority – deficit reduction. This of course assumes that intermediate events don’t change that forecast, either for better or for worse.

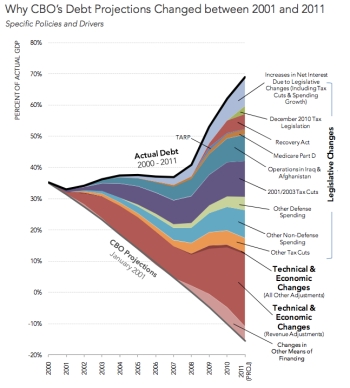

It’s worth exploring what caused that deficit in the first place. Ezra Klein wrote a great piece last week on Republicans’ odd willingness to trust 30-year CBO projections. He used the chart below from a Pew Foundation report to show how wildly off the CBO can be in terms of even 10-year projections. Note that the chart isn’t entirely up-to-date, but I think the broad conclusions are the same.

I want to talk about a point different from the one Klein made, namely that much of the rise in debt is self-inflicted. It’s us scoring on our own goal through legislative choices like unnecessary tax cuts that disproportionately benefit the wealthy and a wholly unnecessary war in Iraq. And, as must be pointed out, the most egregious examples started under the last administration.

Four big facts stand out to me:

- The biggest single driver of debt growth has been the reduction in revenue caused by cyclical downturns in the economy, especially the recession that started in 2007-08. As we are starting to see, the number one thing the US can do to stabilize deficit spending is to grow the economy. We can’t cut our way to no debt. This seems like a basic fact to me, but it’s not necessarily accepted wisdom in Washington, especially among Republicans.

- It’s hard to overstate how damaging the 2001/2003 tax cuts under GW Bush have been to debt levels. After the economic downturn, these tax cuts were the single greatest contributor to rising debt. If this doesn’t serve to dispel the fanciful notion that on their own tax cuts always raise revenue, I don’t know what will.

- The tax cuts and war in Iraq were entirely unnecessary. They were very poor choices and, in the case of the Iraq War, it’s consequences reached far beyond helping to explode the debt. These are examples of us self-inflicting pain. I’d add the 2009 decision to continue and to escalate the war in Afghanistan – a decision made by Obama – to this list as well.

- TARP and the 2009 stimulus barely register as major contributors to the debt. Combined, they account for <7% of the rise in the debt after 2001. The two wars and the 2001/2003 tax cuts account for 4x the rise in debt. If Republicans really want to address the debt issue and win back public support at the national level, they need to honestly reckon with this fact. They haven’t so far and will continue to lose national elections until they do.

As best as we can predict the next 10 years, our near term fiscal house is in order. The US economy continues to recover, albeit slowly and weakly. The focus should be on stimulating demand to accelerate this progress.

Much of the fiscal and political problems we’ve had over the last decade are entirely self-created. Compared with the much of the globe, the US has an excellent opportunity to lead the world out of recession and to have a more productive decade than the last. That will not happen, though, if we enact dumb legislation and fail to pass sensible laws (think Immigration). We need to stop scoring on our own goal.